2/2 Crypto, Blockchain, and Tokens —Part 2

Why Banks and Governments Care**

If blockchain and crypto were just a trend, banks and governments wouldn’t spend time, money, or energy studying it.

They do because this technology solves real problems inside systems they already run.

As a nurse, I’ve learned something important: systems don’t change because people like them. They change because the old way becomes too slow, too expensive, or too risky to maintain.

Finance is at that point.

The Problem With the Current Financial System

Most people assume money moves instantly.

It doesn’t.

When you send money:

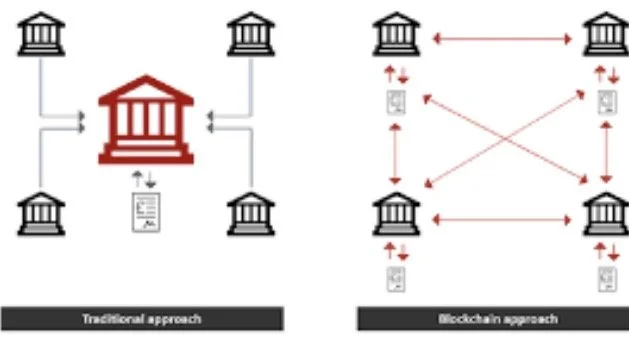

It passes through multiple institutions

Each one keeps its own record

Settlement can take days

Errors are reconciled manually

This is like a patient being transferred between hospitals—faxed records, duplicated charts, delayed information, and room for mistakes.

The system works, but it’s inefficient.

Why Blockchain Changes the Back End (Not the Front)

Here’s the key misunderstanding:

Blockchain isn’t replacing banks—it’s upgrading the plumbing behind them.

Patients don’t see the EMR upgrade but hospitals care deeply when:

Records update instantly

Errors drop

Costs fall

Compliance improves

Blockchain does the same thing for money.

Instead of each institution keeping separate ledgers, everyone references one shared, verified record.

Less reconciliation.

Less delay.

Less risk.

Why Governments Are Involved (Even If They Sound Skeptical)

Governments don’t adopt new systems quickly. They regulate them slowly.

That’s not rejection—that’s caution.

Blockchain introduces:

Transparent records

Traceable transactions

Automated compliance

Reduced fraud

Those are not threats to governments they’re advantages.

The hesitation isn’t “Does this work?”

It’s “How do we integrate this without breaking everything else?”

That takes time.

Why Regulation Comes After Innovation

Historically, regulation follows this pattern:

New tech appears

Early adopters test it

Risks are identified

Rules are written

Standards are enforced

Healthcare does this constantly. Finance is no different.

The internet existed before privacy laws.

Electronic records existed before compliance frameworks.

Blockchain is simply earlier in that same cycle.

Why Institutions Can’t Ignore This

Large institutions care about:

Speed

Cost

Risk

Scalability

Blockchain addresses all four.

Even if institutions don’t like change, they can’t ignore math.

When a system is:

Faster than existing rails

Cheaper at scale

More transparent

More resilient

…it becomes a competitive advantage.

Eventually, not using it becomes the risk.

Crypto Is a Tool, Not a Protest

This technology isn’t about overthrowing systems.

It’s about modernizing them.

That’s why banks study it.

That’s why governments regulate it.

That’s why developers keep building it.

And that’s why the conversation matterseven if you never buy a token.

Final Thought

Blockchain didn’t appear because people wanted something new.

It appeared because the old system could no longer keep up with a digital world.

Just like in healthcare, upgrades are messy, slow, and uncomfortable but they happen because they’re necessary.

Crypto isn’t about rebellion.

It’s about infrastructure.

And once you understand that, the entire conversation changes.