2/2 Crypto, Blockchain, and Tokens —Part 2

Why Banks and Governments Care**

If blockchain and crypto were just a trend, banks and governments wouldn’t spend time, money, or energy studying it.

They do because this technology solves real problems inside systems they already run.

As a nurse, I’ve learned something important: systems don’t change because people like them. They change because the old way becomes too slow, too expensive, or too risky to maintain.

Finance is at that point.

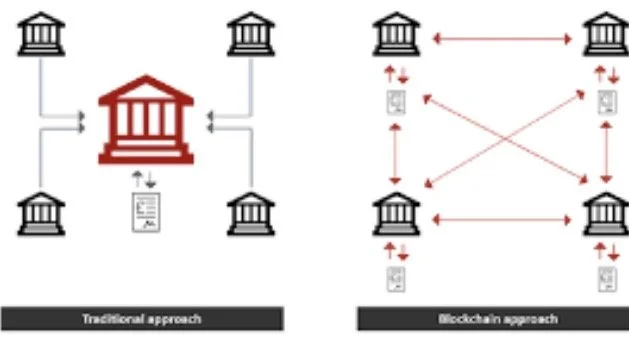

The Problem With the Current Financial System

Most people assume money moves instantly.

It doesn’t.

When you send money:

It passes through multiple institutions

Each one keeps its own record

Settlement can take days

Errors are reconciled manually

This is like a patient being transferred between hospitals—faxed records, duplicated charts, delayed information, and room for mistakes.

The system works, but it’s inefficient.

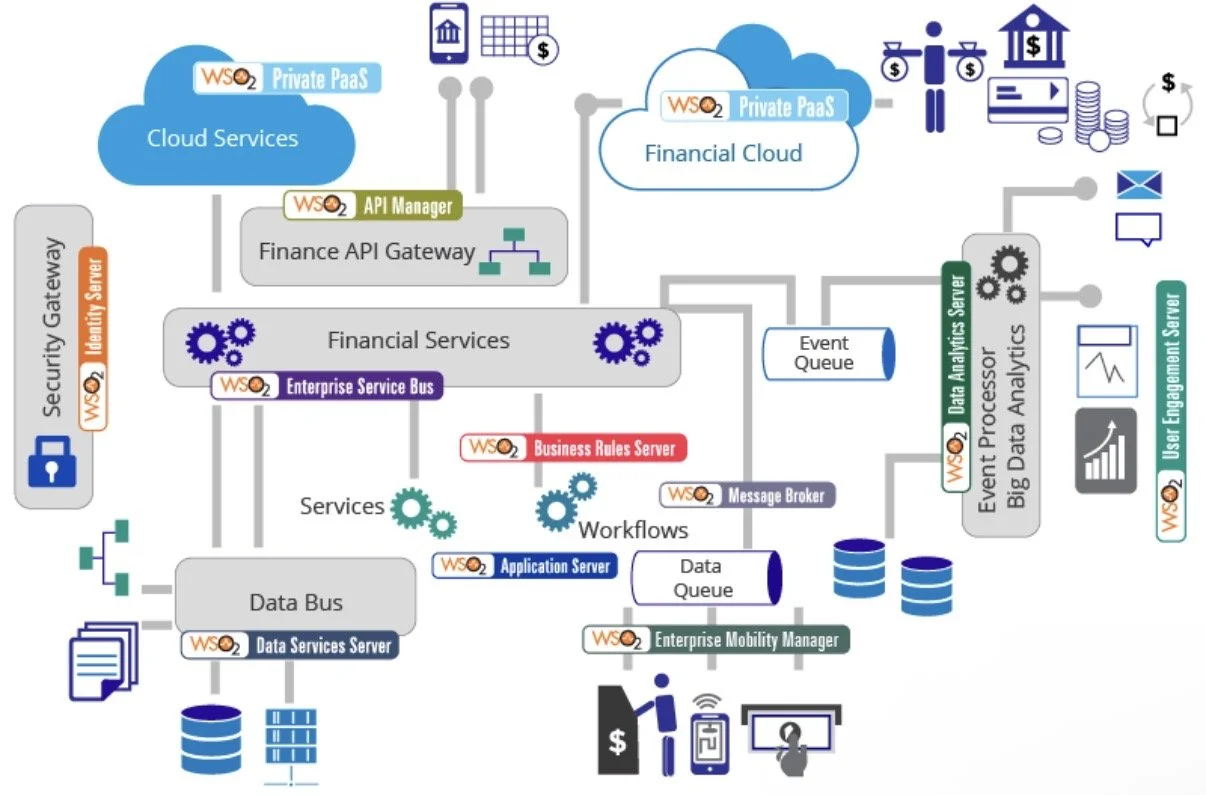

Why Blockchain Changes the Back End (Not the Front)

Here’s the key misunderstanding:

Blockchain isn’t replacing banks—it’s upgrading the plumbing behind them.

Patients don’t see the EMR upgrade but hospitals care deeply when:

Records update instantly

Errors drop

Costs fall

Compliance improves

Blockchain does the same thing for money.

Instead of each institution keeping separate ledgers, everyone references one shared, verified record.

Less reconciliation.

Less delay.

Less risk.

Why Governments Are Involved (Even If They Sound Skeptical)

Governments don’t adopt new systems quickly. They regulate them slowly.

That’s not rejection—that’s caution.

Blockchain introduces:

Transparent records

Traceable transactions

Automated compliance

Reduced fraud

Those are not threats to governments they’re advantages.

The hesitation isn’t “Does this work?”

It’s “How do we integrate this without breaking everything else?”

That takes time.

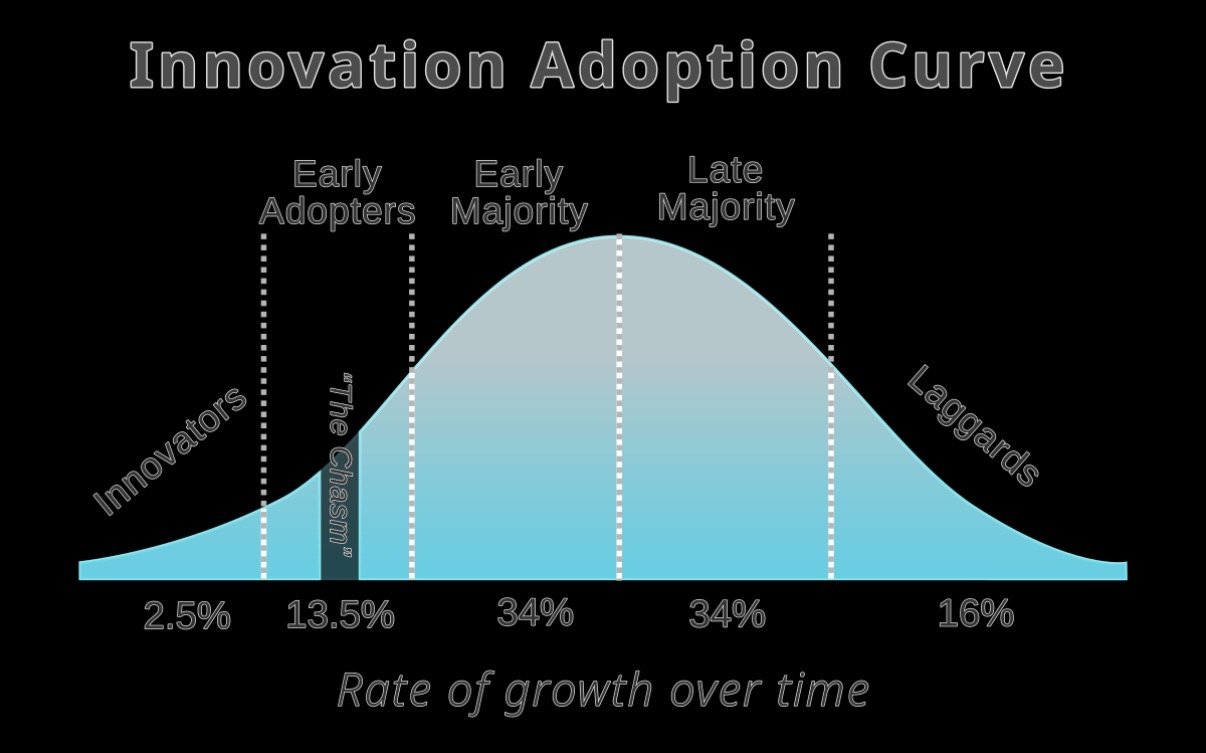

Why Regulation Comes After Innovation

Historically, regulation follows this pattern:

New tech appears

Early adopters test it

Risks are identified

Rules are written

Standards are enforced

Healthcare does this constantly. Finance is no different.

The internet existed before privacy laws.

Electronic records existed before compliance frameworks.

Blockchain is simply earlier in that same cycle.

Why Institutions Can’t Ignore This

Large institutions care about:

Speed

Cost

Risk

Scalability

Blockchain addresses all four.

Even if institutions don’t like change, they can’t ignore math.

When a system is:

Faster than existing rails

Cheaper at scale

More transparent

More resilient

…it becomes a competitive advantage.

Eventually, not using it becomes the risk.

Crypto Is a Tool, Not a Protest

This technology isn’t about overthrowing systems.

It’s about modernizing them.

That’s why banks study it.

That’s why governments regulate it.

That’s why developers keep building it.

And that’s why the conversation matterseven if you never buy a token.

Final Thought

Blockchain didn’t appear because people wanted something new.

It appeared because the old system could no longer keep up with a digital world.

Just like in healthcare, upgrades are messy, slow, and uncomfortable but they happen because they’re necessary.

Crypto isn’t about rebellion.

It’s about infrastructure.

And once you understand that, the entire conversation changes.

1/2 Series-Crypto, Blockchain, and Tokens. Explained Like You’ve Never Heard of Them- Part 1

If the word crypto makes your brain shut down, you’re not alone. Most people hear it explained in technical language, price talk, or hype and none of that helps.

So let’s start over. No charts. No predictions.

Just what this technology actually is, explained in a way that makes sense.

As a nurse, I’ve learned that complex systems only feel complicated until someone explains what each part does. Blockchain technology is no different.

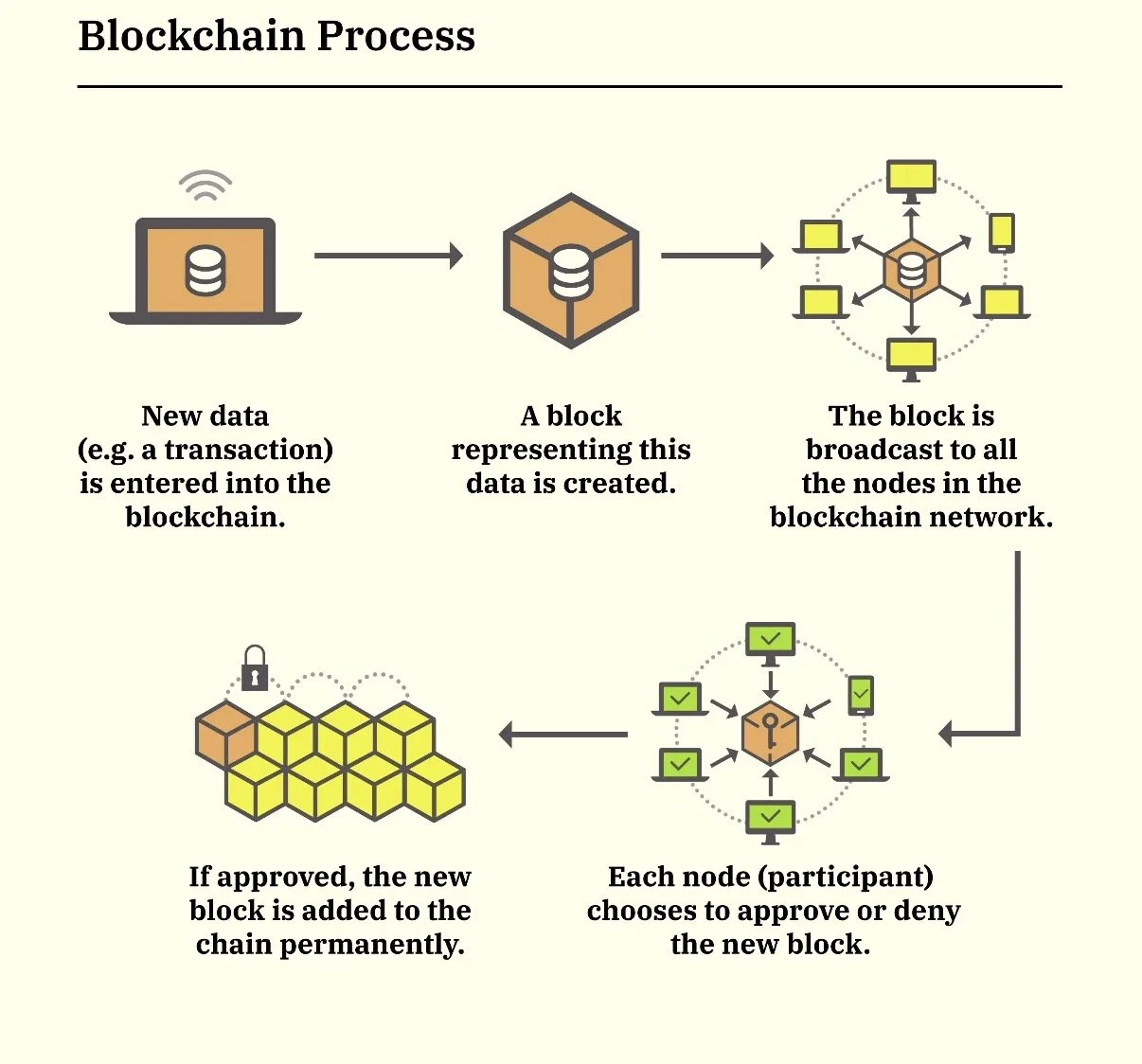

Think of Blockchain Like a Medical Chart System

Imagine a patient chart but instead of being stored in one hospital, copies of that chart exist everywhere at the same time.

No single person controls it

No one can secretly alter it

Every update is time-stamped and visible

That’s a blockchain.

A blockchain is simply a shared digital record system. It keeps track of transactions the way a medical chart keeps track of care accurately, chronologically, and permanently.

Once something is written to it, it can’t be erased or altered.

So What Is Crypto?

Crypto is just digital value that lives on a blockchain.

Think of it like this:

Cash = physical value

Credit cards = value moved through banks

Crypto = value moved directly between people using technology

No bank in the middle.

No office hours.

No waiting days for settlement.

Crypto is not magic money it’s a new way to move value.

What Are Tokens? (This Is Where People Get Confused)

A token is like a specific tool inside a system.

In healthcare terms:

The hospital = blockchain

The patient chart system = network

The badge, key, or medication order = token

Tokens are used to:

Pay fees

Move value

Access services

Secure the network

Not all tokens are the same. Some are used for payments. Some are used for voting. Some represent ownership. Some power applications.

That’s why saying “crypto is one thing” is like saying “medicine is one thing.” It’s not.

Why Blockchain Technology Matters More Than Price

Most people get distracted by price.

But price is just a side effect.

Technology is the point.

Blockchain allows:

Faster settlement (seconds instead of days)

Lower costs (less middlemen)

Transparency (public records)

Automation (rules built into the system)

In simple terms:

Blockchain does for money and records what the internet did for communication.

Common Crypto Terms (Plain English)

Here’s some lingo you might hear—and what it really means:

Blockchain: A shared digital record that can’t be altered

Token / Coin: A digital unit used on a blockchain

Wallet: An app that lets you hold and send crypto (like a digital ID + key)

Gas / Fees: Small costs paid to use the network

Decentralized (DeFi): Systems that work without banks

Ledger: The record of all transactions

On-chain: Happening directly on the blockchain

No mystery just new vocabulary.

Why This Technology Exists at All

The current financial system works—but it’s slow, expensive, and built on trust in middlemen.

Blockchain reduces the need for trust by replacing it with verification.

Instead of:

“Trust us, we’ll fix it later”

It says:

“Everyone can verify it in real time”

That shift is bigger than crypto prices. It’s about infrastructure.

Final Thought

You don’t need to understand everything.

You don’t need to buy anything.

You don’t need to believe the hype.

But understanding why this technology exists is importantbecause systems don’t change overnight, they evolve quietly until they’re unavoidable.

Just like in healthcare.

Crypto isn’t about getting rich fast.

It’s about building better systems for how value moves in a digital world.

And once you see it that way, it stops being confusing and starts making sense.

XRP Wasn’t Built for Banks. It Was Built to Make Them Optional

One of the most persistent myths in crypto is that XRP was created to serve banks.

I’ve heard it for years.

So has anyone who’s spent real time around this space.

But the deeper I’ve gone into the early design decisions, the original code, and the historical context the more obvious it’s become that this narrative is backwards.

XRP didn’t start as a “bank coin.”

It became interesting to banks later and that distinction matters.

Looking Back Before the Labels

To understand XRP, you have to rewind to 2011–2012, before marketing narratives hardened and before crypto tribalism turned everything into slogans.

At that time, the dominant blockchain was Bitcoin. It proved something important — that digital scarcity and peer-to-peer value transfer were possible — but it also exposed serious limitations:

Mining was expensive and wasteful

Settlement was slow

Fees were unpredictable

Power increasingly concentrated with scale

The response wasn’t to “compete with banks.”

It was to remove unnecessary intermediaries altogether.

That’s the context in which the XRP Ledger launched in June 2012.

Not as a product.

Not as a company offering.

As infrastructure.

The Original Design Tells the Story

The XRP Ledger made several radical choices that are easy to overlook today:

No mining

Fast deterministic finality

A built-in decentralized exchange

Native token issuance

Low, predictable fees

Those are not features you design to make banks more powerful.

They are features you design to make permission unnecessary.

The goal wasn’t to improve the existing system.

It was to create an alternative rail where anyone could move value without asking.

That’s not ideology that’s architecture.

Why the “Bank Coin” Narrative Emerged

The “XRP is for banks” label didn’t exist in the early years.

It emerged later, after the company originally known as OpenCoin rebranded and focused on enterprise adoption as a path to scale.

That decision made sense strategically. Banks control liquidity. Banks move large volumes. If you want global adoption quickly, you go where the flows already are.

But here’s the critical part that often gets missed:

XRP the asset is not owned or controlled by the company using it.

The ledger is public.

The rules are fixed.

No bank gets special privileges.

When banks interact with XRP, they aren’t gaining control — they’re operating on neutral infrastructure.

And neutral infrastructure is exactly what incumbents fear long-term.

The Irony of Institutional Adoption

There’s an irony here that I don’t see discussed enough.

When banks adopt closed systems, they reinforce their power.

When banks adopt open systems, they give up structural advantages:

No private ledgers

No preferential access

No hidden fees

No ability to unilaterally block users

That’s the opposite of capture.

It’s exposure.

The fact that institutions are willing to interact with XRP today doesn’t mean XRP serves them.

It means the system is strong enough that even incumbents have to adapt to it.

XRP vs. Bitcoin: Different Problems, Different Solutions

Bitcoin focused on censorship resistance and scarcity.

XRP focused on liquidity, interoperability, and settlement efficiency.

Neither approach is “right” or “wrong” — but they are not interchangeable.

The XRP Ledger was designed for a world where:

Multiple currencies exist

Value needs to move between systems

Liquidity matters more than hoarding

Speed and cost are non-negotiable

That makes it especially relevant to real-world finance not because it was built for banks, but because it was built for value movement at scale.

My Personal Take

I don’t see XRP as a pro-bank asset or an anti-bank weapon.

I see it as something more disruptive than either label allows.

XRP represents infrastructure that doesn’t care who you are.

Banks can use it.

Governments can use it.

Individuals can use it.

And that’s the point.

When power is embedded in math instead of permission, no single group gets to own the system.

That’s not serving banks.

That’s making them optional.

Final Thought

Narratives are easy. Architecture is harder.

If you judge XRP by headlines, you’ll miss it.

If you judge it by who’s experimenting with it today, you’ll misunderstand it.

But if you judge it by what it allows anyone to do without asking, the picture becomes much clearer.

XRP wasn’t built to protect the financial system as it exists.

It was built to outgrow the need for gatekeepers altogether.

And that’s exactly why it still matters.

Why Most People Will Miss the Biggest Transfer of Wealth

Most people won’t miss the next major transfer of wealth because they lack intelligence.

They’ll miss it because they never take the time to understand how financial systems actually work.

As a nurse, I’ve spent my career inside systems healthcare systems, regulatory systems, operational systems. Over time, I learned an important truth: outcomes are shaped by structure, not noise. The same is true in finance.

When you study systems instead of headlines, patterns become obvious.

Understanding the System Changed Everything

My perspective shifted when I stopped watching price movements and started asking better questions:

How does money move across borders?

Why do settlements take days in a digital world?

Who benefits from friction, delays, and opacity?

What happens when technology removes those inefficiencies?

Once you understand the mechanics behind global finance, speculation fades. What remains is clarity.

The existing financial system isn’t slow by accident it was built for a different era. Today, the world moves in real time, yet the rails that support global money movement have not kept up. That gap creates opportunity.

When Technology Outpaces Regulation

This is where many people get stuck. They see regulation lagging behind new technology and assume that means rejection. Historically, the opposite is true. Regulation almost always follows innovation not the other way around.

New systems emerge. Institutions resist. Governments study. Rules are written. Adoption follows.

We are living in that in-between phase right now. It’s uncomfortable because certainty hasn’t arrived yet. But uncertainty is precisely where opportunity exists.

As a healthcare professional, I’ve seen this before new practices, new tools, new standards. At first, they’re questioned. Eventually, they become required.

Those that don’t want to or adapt get left behind. I used to see them as dinosaurs “old”

Why Most People Will Be Late

Most people wait for permission.

They wait for:

Clear regulatory approval

Institutional validation

Positive media narratives

Prices that already reflect adoption

By the time those signals appear, the transfer of wealth is no longer forming it’s already underway.

Early understanding always looks risky. Late confirmation always feels safe. History shows which group benefits.

The Quiet Nature of Real Change

The biggest shifts don’t announce themselves. They happen quietly, beneath the surface, while attention is focused elsewhere.

Technology doesn’t need belief—it needs utility. When something is faster, cheaper, more transparent, and more efficient, it doesn’t disappear. It integrates.

Regulation doesn’t stop progress. It documents it after the fact.

That understanding is why I’m patient. It’s why I focus on fundamentals instead of headlines. And it’s why I don’t feel the need to convince anyone.

Final Thought

The next transfer of wealth won’t divide smart from foolish.

It will divide those who understand systems from those who follow narratives.

As a nurse and an entrepreneur, I’ve learned to respect structure, timing, and inevitability. The same principles apply here.

You don’t need to agree.

You just need to observe closely.

Because when clarity finally arrives, most people will realize the shift didn’t happen overnight it happened while they were waiting for permission to believe.

I Built the Life. Now I’m Going to Live It

I Started Working Before I Knew What Rest WaS

I’ve been working since I was 12 or 13 years old. Before resumes, before titles, before careers. I sold things on the street. I spent summers helping my sister run her hat and sports store. I got my first “real” job in middle school.

Work wasn’t optional it was normal. It was survival, responsibility, and pride all wrapped into one. I learned early that effort equals progress, and I carried that belief with me for decades.

Fast Forward: 37 Years Old, Over 20 Years of Work

Today, I’m recently 37. I’ve been working for over 20 years straight. I’m a father of three. I’ve spent my adult life in one of the most demanding industries there is: nursing.

My career took me across multiple disciplines clinical care, leadership, operations, compliance and most recently into administration as an assisted living administrator. I’ve cared for people at their most vulnerable stages of life. I’ve led teams, solved crises, absorbed stress, and carried responsibility that doesn’t clock out at the end of the day.

It’s meaningful work. It’s honorable work.

And it has taken a real beating out of me.

The Cost of Always Operating at Peak

For years, I’ve operated at peak levels mentally, emotionally, professionally. Always on. Always thinking. Always solving. Always anticipating the next problem before it arrives.

But there’s a cost to never letting your brain settle. To never truly resting. To living in a constant state of responsibility. Over time, even purpose-driven work can drain you when there’s no space left for yourself.

I reached a point where I realized I wasn’t burnt out because I hated what I did. I was burnt out because I had given everything to it.

Choosing to Step Away

So I made a decision that didn’t come lightly:

I’m walking away from the industry for now.

I’m taking a break.

I’m leaving the country.

Not to run away but to finally slow down. To live. To spend real time with my family. To admire life instead of racing through it. To appreciate everything that has come from years of discipline, sacrifice, and hard work.

Refocusing Energy Instead of Burning It

I’ve been fortunate deeply fortunate. My career has been rewarding. My investments have been rewarding. Especially in crypto, where patience, conviction, and education opened doors I never imagined years ago.

Now, instead of pouring my energy into constant output, I’m refocusing it. Learning without pressure. Exploring opportunities without urgency. Letting curiosity replace stress. Letting vision breathe.

Crypto remains a space of opportunity, innovation, and freedom but this time, I approach it from a place of clarity, not exhaustion.

From Caring for Others to Caring for Myself

Caring for people has always been in my nature. It’s who I am. It’s what pulled me into healthcare in the first place.

But somewhere along the way, I forgot that caretakers need care too. That leaders need rest. That providers are still human.

This chapter is about caring for myself mentally, physically, emotionally so that whatever comes next is built from wholeness, not depletion.

Gratitude for the People Along the Way

I wouldn’t be here without my friends, my family, my children, and everyone who believed in me, challenged me, and stood by me through long hours and heavy seasons. Your support never went unnoticed even when I was too busy to say it out loud.

This isn’t an ending.

It’s a pause.

A recalibration.

A choice to finally enjoy the life I’ve spent decades building.

And for the first time in a long time, I’m allowing myself to simply live

Leadership Fatigue in Senior Care: When the Weight of Work Shapes Everything Else

Leadership in the senior care industry is unlike most professions. It demands constant vigilance, emotional intelligence, regulatory awareness, and ethical decision-making all while caring for vulnerable lives. Over time, this level of responsibility doesn’t just stay at work. It shapes how leaders think, respond, and expect outcomes everywhere.

This is not a flaw. It is a byproduct of carrying weight for too long.

The Nature of Senior Care Leadership

Senior care leaders operate in an environment where:

Mistakes have real human consequences

Compliance is non-negotiable

Staffing instability is constant

Families expect perfection during emotional moments

Regulators expect consistency regardless of circumstances

You are conditioned to anticipate risk, intervene early, and maintain standards even when resources are limited. Over time, this trains your nervous system to stay in leadership mode at all times.

High Standards Are Learned, Not Accidental

Most leaders in this space did not wake up one day feeling frustrated with inefficiency or inconsistency. These traits are learned through years of:

Cleaning up after preventable mistakes

Managing crises that could have been avoided

Holding accountability when others avoided it

Carrying responsibility that others could not

The frustration doesn’t come from ego it comes from experience. You have seen what happens when standards slip, and you refuse to let that happen on your watch.

When Work Conditioning Follows You Home

Because senior care leadership requires constant oversight, many leaders become conditioned to expect more — clarity, responsibility, follow-through — not only from staff, but subconsciously from family, friends, and even children.

This often shows up as:

Less tolerance for repeated mistakes

Expecting emotional regulation under stress

Coaching instead of connecting

Holding others to timelines and accountability they never agreed to

These behaviors are not intentional. They are the result of living in a role where letting things slide is not an option.

The Leadership Blind Spot

One of the hardest realizations for leaders is this:

The traits that make me effective at work can strain my personal relationships.

At work, structure creates safety.

At home, structure without softness creates distance.

Senior care leaders are trained to correct, redirect, and prevent risk. But personal relationships don’t operate on regulatory frameworks or performance metrics.

Leadership Fatigue vs. Burnout

Burnout is disengagement.

Leadership fatigue is hyper-engagement for too long.

Most senior care leaders experiencing this fatigue:

Still care deeply

Still show up

Still protect residents and teams

Still carry moral responsibility

But they feel heavier, more irritable, and less patient — not because they don’t care, but because they care constantly.

A Necessary Leadership Recalibration

The solution is not lowering standards at work residents depend on them.

The solution is learning where leadership must soften without breaking.

This may mean:

Recognizing when correction is not required

Allowing others to own outcomes

Accepting imperfect execution outside of regulated environments

Creating intentional moments where you are not responsible for everyone

Great leaders do not lose effectiveness by resting.

They regain clarity.

The Quiet Truth of Senior Care Leaders

Many of the best leaders in senior care carry this struggle silently. They don’t complain because they know the stakes. They don’t disengage because people rely on them.

But leadership was never meant to be carried alone.

If you are feeling this weight, know this:

You are not failing

You are not “too much”

You are responding exactly how someone conditioned by responsibility would

The next level of leadership isn’t harder it’s healthier.

Sometimes the most powerful thing a leader in senior care can do…

is recognize that strength also requires release.

True leadership is not measured by how much you carry but by how well you sustain yourself while carrying it.

Beyond Crypto: How Blockchain Will Transform Everyday Life

How Blockchain Technology Can Improve Our Future

When most people hear “blockchain,” they immediately think of Bitcoin or cryptocurrencies. But the truth is, blockchain is much bigger than just digital money. It’s a technology that can reshape the way we live, work, and interact by making systems more transparent, secure, and efficient. Let’s explore some real-world use cases that are already being tested or rolled out and how they could impact your everyday life.

Real Estate: Simplifying Ownership and Trust

Buying a home today involves mountains of paperwork, escrow agents, and lawyers — all because of one thing: lack of trust. With blockchain, property ownership can be tokenized and recorded permanently, removing the need for middlemen.

Example: Instead of waiting weeks for title verification, you could transfer property ownership with a single blockchain transaction.I’ve personally gone through this process several times with owning properties and making purchases let me tell you it’s frustrating , dragging and it has been the only option due to lack of “trust” between several parties.

Shared ownership becomes easier too: imagine splitting ownership of a vacation home among family members, with blockchain keeping a transparent record of everyone’s stake. I often think—what if there was a way to own a property I couldn’t afford on my own, but still share in the benefits? Watch this is coming to a market near you ;)

With blockchain, that’s possible. Imagine splitting the cost of a property with complete strangers, yet never needing to meet or trust them personally—because the blockchain keeps a secure, transparent record of everyone’s share

This removes friction, speeds up deals, and lowers costs for buyers and sellers.

Universal Digital ID & Verification

Think about how many times you need to prove who you are — at the bank, airport, or DMV. Today, every system stores your data separately, which makes it both inconvenient and vulnerable to hacks.

With a blockchain-based universal ID, you could:

Prove your identity once, then use it securely anywhere.

Replace physical driver’s licenses and passports with tamper-proof digital versions.

Protect your healthcare records or credit history without handing over copies to every organization that asks.

This gives you more control over your data while reducing fraud.

Tokenization of Assets (Art, Cars, and More)

Blockchain allows almost anything of value to be “tokenized,” meaning represented as a digital asset.

Art: Instead of one person owning a $10M painting, thousands of people could own a piece of it through fractionalized tokens.

Cars: A group of friends could co-own a collectible car, and blockchain would track ownership percentages automatically.

Real Estate: You could invest in a piece of a shopping mall or apartment building opportunities that were once reserved for the wealthy.

This opens investing to everyone, not just big corporations or wealthy individuals.

Healthcare Data

Today, your medical records are scattered between hospitals, clinics, and insurance companies. That means every time you switch doctors, you start over.

Blockchain could store your health records securely, giving you control over access.

You decide which doctor, hospital, or specialist can view your data.

Emergency rooms could instantly see your allergies or prescriptions, saving time and lives.

Stocks & Financial Markets – 24/7 Access

Traditional stock markets operate only on weekdays and shut down after business hours. With blockchain, stocks could be tokenized and traded around the clock, just like crypto.

Imagine buying or selling Apple stock on a Sunday night.

Settlement times would shrink from days to minutes.

This democratizes investing and removes the inefficiencies of the current system.

Decentralized Finance (DeFi)

Right now, banks control who gets loans, who earns interest, and what fees you pay. DeFi flips that system by allowing peer-to-peer financial services without middlemen.

You could lend money directly to others worldwide and earn interest.

Small businesses in developing countries could access capital without relying on local banks.

Fees are reduced, and access is broadened.

DeFi is essentially what banking would look like if it were rebuilt for the internet age.

Global Transfers & Remittances

Sending money internationally is still slow and expensive. Western Union, for example, often charges up to 10% in fees. Blockchain-based transfers allow instant payments worldwide at a fraction of the cost.

A worker in the U.S. could send money to family in Mexico in seconds, with no middlemen.

Businesses can pay international suppliers instantly, speeding up global commerce.

Supply Chains & Logistics

When you buy food at the grocery store, do you really know where it came from? Blockchain can track every step of a product’s journey from farm to shelf.

For food, this means safer supply chains and faster recalls in case of contamination.

For fashion, it ensures that “organic cotton” or “sustainable leather” claims are genuine.

For electronics, it prevents counterfeit products from slipping into the market.

This level of transparency builds consumer trust.

Voting & Governance

Blockchain could also change how we participate in democracy.

Secure digital voting systems could make elections more accessible, especially for people abroad or with mobility issues.

Fraud becomes nearly impossible because votes are permanently recorded and verified.

This could drastically increase participation and trust in elections.

Everyday Applications You Might Not Think About

Music & Entertainment: Artists can release music directly to fans, cutting out record labels and ensuring fair royalties.

Insurance: Claims could be automated using smart contracts. For example, if your flight is canceled, blockchain could trigger an instant refund.

Education & Credentials: Degrees and certifications could be issued on blockchain, preventing fraud and making job applications smoother.

The Bottom Line

Blockchain isn’t just about cryptocurrency it’s about trust, efficiency, and access. From real estate and healthcare to finance and food safety, this technology has the potential to remove barriers, lower costs, and empower individuals globally.

As blockchain continues to evolve, the real winners will be everyday people who benefit from systems that are finally designed to be transparent, fair, and user-first.

The Hidden Cost of Assisted Living Referral Agencies (and Why a Transparent Alternative Is Needed)

Introduction: What Families Don’t Know About Assisted Living Referrals

When families search for help placing a loved one into Assisted Living, they often turn to referral agencies like A Place for Mom or Caring.com. These companies advertise as “free” services for families but in reality, they make money by charging the facilities hefty fees for every placement.

Behind the scenes, this system can drain small and mid-sized operators of thousands of dollars per resident, reducing resources that should go directly to caregivers, nurses, and residents.

This blog will explain:

How referral agencies really make money

The financial impact on operators and families

What government investigations have revealed

Why monopolies hurt small businesses

And how new models, like Jessica Solomon’s Next Best Home, are changing the game

How Assisted Living Referral Agencies Really Make Money

Referral agencies make their money by charging placement fees to senior living communities. While families don’t get a bill, operators do.

Fees often equal the first month’s rent and care charges

These can run from $5,000 to $12,000+ per resident

Agencies advertise as “no cost to families,” but these expenses drive up overall pricing and limit what operators can reinvest

Example: The Financial Drain

A small community that admits 10 residents per year through a referral agency at $10,000 each loses $100,000 annually.

A mid-sized operator admitting 30 residents per year could lose more than $360,000 annually.

That’s money that could instead fund:

Higher caregiver wages and retention bonuses

Hiring additional nurses or activity coordinators

Facility upgrades and safety improvements

Better dining, memory care, or wellness programs

Instead, those funds are siphoned into referral agencies that provide no direct care.

Government Investigations Into Referral Agencies

Referral agencies have faced increasing scrutiny in recent years:

Senator Bob Casey, Chair of the Senate Special Committee on Aging, demanded answers from A Place for Mom over misleading claims that their services are “unbiased” and “free” while only promoting facilities that pay commissions.

A Washington Post investigation revealed that over a third of facilities awarded A Place for Mom’s “Best of Senior Living” designation had recent citations for neglect or unsafe conditions.

The Better Business Bureau has documented numerous complaints from providers who were billed by referral agencies even without requesting services.

Reports show that families are rarely told how the referral business model works—that they are being “sold” to whichever operator pays the highest commission.

These findings highlight why the current system lacks transparency and can distort family decision-making.

How Referral Agencies Create a Monopoly

Referral giants like A Place for Mom dominate:

Advertising and SEO – They spend millions to appear at the top of every Google search for “assisted living near me.”

Lobbying and influence – Their large budgets shape legislation and oversight conversations, drowning out smaller providers.

Biased visibility – Facilities that can’t afford high referral fees are buried, even if they provide excellent care.

The result? Families see a narrowed pool of options, while independent and smaller operators are forced to either pay up or lose residents.

The Alternative: Jessica Solomon’s Next Best Home

While the old referral model drains communities, innovators are building transparent alternatives. One promising example is Jessica Solomon’s next best home.com

How Next Best Home Works

Full transparency – Families and providers know exactly how fees work. No hidden commissions, no inflated referral charges.

Fair monetization – Instead of charging operators thousands per resident, the platform uses creative shared-value revenue streams.

Banker & attorney partnerships – Families gain access to financial planning and elder law guidance—critical services for seniors navigating contracts, payment options, and long-term care planning.

Community-first design – By reducing unnecessary fees, operators can reinvest into staff wages, resident programs, and quality of care.

Why It’s Better

Families win – They get unbiased placement plus financial/legal tools to make better decisions.

Operators win – They save tens or hundreds of thousands annually.

Staff & residents win – More money is available for better wages, training, and quality of life improvements.

This is a true win-win-win model—a sharp contrast to the traditional referral monopoly.

What Families Should Know Before Using a Referral Agency

If you’re considering assisted living for a loved one, keep these points in mind:

Ask how referral agencies get paid. If it’s “free to you,” the facility is paying—often heavily.

Do your own research. Don’t rely only on the facilities shown by referral sites. Visit smaller, local communities directly.

Check quality ratings. State inspection reports, staffing levels, and reviews from residents matter more than badges like “Best of Senior Living.”

Explore alternatives. Transparent platforms like Next Best Home are designed to prioritize both families and operators.

Conclusion: Time for Transparency in Senior Care

Referral agencies claim to help families, but in reality, they’ve built monopolies that drain operators and hide the true cost of placement. The money they extract—sometimes hundreds of thousands per year from a single community—could instead fund caregivers, nurses, and programs that directly improve residents’ lives.

Thankfully, leaders like Jessica Solomon and next best home.com are proving there’s a better way: transparent, fair, and supportive of everyone involved. Families, staff, and residents all deserve that change

How to Make Money in Crypto: Proven Strategies That Work

How to Make Money in Crypto: My Journey & Proven Ways You Can Too

If you’ve been hearing about people making (and sometimes losing) fortunes in crypto, you’re probably curious: how do people actually make money in this space?

The truth is, there isn’t just one way. Crypto is like a digital economy with dozens of income streams—and the best part is, you can choose what fits your lifestyle, risk tolerance, and creativity.

I’ve personally made money through several strategies—some simple, some advanced—and I’ll break them all down here so even if you’re new, you’ll walk away with a clear picture of what’s possible.

1.

Buying & Holding (HODLing)

This is the easiest and most popular strategy. You buy a cryptocurrency (like Bitcoin, Ethereum, or XRP) and simply hold it for months or years, waiting for its value to increase.

Example: If you bought XRP at $0.20 and it later hit $3.00, your $1,000 investment turned into $15,000.

This requires patience but almost no effort—perfect for beginners. Diamond Hands is what we call the courage to hold through the upside.

2.

Trading

Unlike holding, trading means buying and selling more frequently to profit from price swings. Crypto markets never sleep, so opportunities are always there.

Day trading: Buying/selling within hours.

Swing trading: Holding for days or weeks.

Example: If Bitcoin dips to $100,000 and rebounds to $115,000 traders can pocket the difference.

It’s riskier, but if you like fast-paced decision-making, this can be exciting (and profitable).

3.

Margin Trading

This is trading with borrowed money to amplify gains. If you open a 10x leveraged trade, a 5% price move could give you a 50% profit.

⚠️ But beware: if the trade goes against you, losses are amplified too. Trust me, I’ve learned this lesson the hard way.

4.

Collateralized Loans

One of my favorite strategies: you can borrow against your crypto instead of selling it

Example: Let’s say you own $50,000 in XRP or Bitcoin. Instead of selling, you can lock it up as collateral, borrow $25,000 in stablecoins, and buy even more crypto—or use it for real-world expenses.

This way, you keep your XRP or Bitcoin while still accessing liquidity.

This is essentially what the ultra-wealthy do with their assets—whether it’s businesses or real estate. They leverage those assets to secure loans, avoid triggering taxes by not selling, and still gain access to capital.

You can to!!

5.

Staking

Some cryptocurrencies let you lock your coins in the network to help secure it. In return, you earn passive income (like interest).

Example: Staking 10,000 ADA (Cardano) might earn you 5% annually. It’s like putting money in a savings account, but often with higher returns.

6.

Liquidity Pools (LPs)

On decentralized exchanges like Uniswap or PancakeSwap, you can provide liquidity (basically funding the exchange) and earn fees + rewards.

Think of it like being the house in a casino—you get a cut every time someone makes a trade using your liquidity.

7.

MininG

Mining involves using computer power to validate transactions and earn crypto as a reward.

Back in the day, you could mine Bitcoin on a laptop. Now it requires specialized equipment. Still, people make steady income mining Bitcoin, Ethereum Classic, and other coins.

8.

Hosting & Operating Nodes

Some blockchains pay people to run nodes (computers that help keep the network running).

For example, with projects like Flux or Avalanche, operating a node can earn you consistent rewards—kind of like running a toll booth on the digital highway.

9.

Influencer Partnerships & Promotions

If you build an audience on Twitter, YouTube, or TikTok, projects may pay you to promote their brand.

I’ve personally done influencer partnerships—sharing reviews, updates, or announcements in exchange for payment in crypto or cash.

It’s not just about money; it’s also about becoming a trusted voice in the community.

10.

Content CreatioN

From blogs to podcasts to YouTube videos, content creators get paid through ads, sponsorships, or even direct crypto tips from their audience.

I’ve made money this way too—and the best part is, you’re teaching others while building your own brand.

11.

NFTs (Digital Collectibles)

Some people make serious money by buying, selling, or creating NFTs (digital art, music, or collectibles on the blockchain).

Example: Artists can sell their work as NFTs and keep earning royalties every time it’s resold.

12.

Play-to-Earn Gaming

Blockchain games reward players with crypto or NFTs that can be sold. Think of it as getting paid to play video games.

13.

Yield Farming

This is more advanced. It’s like staking + liquidity pools combined—where you move your funds across platforms to earn the highest returns

14.

Providing Infrastructure (Hivemapper)

Hivemapper is a decentralized mapping project where drivers install dashcams that capture street-level imagery. Instead of one big company (like Google) owning the map, the data is crowd-sourced, and contributors earn tokens for participating.

👉 Best for: Drivers, delivery workers, or rideshare folks who are already on the road and want to earn extra while doing what they normally do.

📡 15.

Building Wireless Networks (Helium)

Helium is a blockchain project that pays people to provide wireless coverage for Internet of Things (IoT) devices. By setting up a small antenna at home, you help connect sensors, scooters, smart devices, and more. In return, you earn Helium tokens (HNT).

👉 Best for: Anyone with stable internet and a good location (urban or suburban) who wants semi-passive income.

16.

Connecting Cars (DIMO)

DIMO rewards car owners for sharing vehicle data through a plug-in device or app. This data (like mileage, efficiency, or maintenance needs) is valuable for building smarter transportation systems. Instead of your data being sold without your permission, you earn for it.

👉 Best for: Drivers who want to monetize their daily commute and help create the future of smart mobility.

These projects show how crypto meets the real world—where everyday actions like driving, parking your car, or plugging in a device can turn into new income streams.

Why Crypto Keeps Me Hooked

The beauty of crypto is that it’s not just about making money—it’s about building financial freedom in new ways. You don’t need permission from a bank, and you can tap into dozens of opportunities from your phone or laptop.

That said, crypto is risky. Prices are volatile. Platforms can fail. Always invest only what you can afford to lose.

But if you’re curious, there’s never been a better time to explore.

👉 So, whether you’re a beginner who just wants to buy & hold or someone ready to dive into advanced strategies like liquidity pools and nodes—the crypto world has a lane for you.

I’ve personally made money in many of these ways, and I’m still learning every day. The key? Start small, stay curious, and never stop exploring.

💡 Want to keep learning with me? Follow my journey on X: @xrpnurse

The XRP Nurse’s Guide to Crypto: Invest Smarter, Start Today 🩺

🚀 Getting Into Crypto: A Beginner’s Guide to Buying, Learning, and Growing

So, you’ve heard about crypto a million times—maybe at work, maybe on the news, or maybe from that one cousin who won’t shut up about Bitcoin at family dinners. But here’s the truth: getting started as a crypto investor is actually way easier than most people think. And I’ll walk you through it, step-by-step.

💻 Step 1: Sign Up on a Crypto Exchange

In the U.S., the easiest way to get your hands on crypto is through a crypto exchange—basically the “bank” of crypto, but without all the middlemen.

Some of the most popular exchanges:

Coinbase

Kraken

Uphold

Binance.US

👉 Here’s my referral link:

https://coinbase.com/join/3RWAQDX?src=ios-link

👉 Or try this one:

https://wallet.uphold.com/signup?referral=f6ea7bb6ba&campaign=uw_p_d_w_acq_raf&utm_source=raf&utm_medium=referafriend

Signing up usually takes just a few minutes. You’ll need to upload an ID, set up your account, and link a debit card or bank account.

💸 Step 2: Buy Your First Coin (Example with XRP

Let’s use XRP as an example—it’s one of my personal favorites because of its speed and low fees.

Open your exchange app.

Search for “XRP.”

Enter how much you want to buy (start small if you’re new).

Confirm the purchase.

Boom—you’re now officially a crypto investor! 🎉

📊 Understanding Market Cap (Why It Matters)

Every project has a market cap, which is just:

Price per coin × Total coins in circulation.

Example: If XRP is $3 and there are ~55 billion coins circulating, the market cap is about $165 billion.

This number tells you the “size” of the project compared to others. Bigger doesn’t always mean better, but it helps you compare Bitcoin, Ethereum, XRP, and newer projects.

🔍 Doing Your Research (DYOR)

Before investing, check out:

The project’s website → What problem are they solving?

Whitepaper → The blueprint of the project.

Community → Are people active on X (Twitter), Reddit, or Discord?

Partnerships → Are real companies using this technology?

Pro tip: Don’t just listen to hype. Hype creates FOMO (fear of missing out), but research creates confidence.

📖 Quick Crypto Dictionary (For Beginners)

Crypto → Digital money that uses blockchain.

Blockchain → A public record of transactions, verified by computers.

Coin → A standalone cryptocurrency (like Bitcoin, XRP).

Token → A project that runs on another coin’s blockchain (like an NFT on Ethereum).

ATH (All-Time High) → The highest price a coin has ever reached.

HODL → “Hold On for Dear Life”—don’t panic sell.

Rekt → When you lose money badly in a trade.

Bullish → Believing prices will rise.

Bearish → Believing prices will drop.

Market Cap → The total value of a coin/project.

FOMO → Fear of missing out.

⚠️ A Word of Caution (But Also Inspiration)

Crypto is still speculative. That means you should only invest what you can afford to lose. Think of it like planting seeds—you don’t dig up the soil every day to see if it’s growing. You water it (invest smart), give it time (HODL), and watch it grow.

Yes, there are risks. Yes, there are wild swings (up and down). But I truly believe crypto is shaping the future of finance—and being early has always been where the biggest opportunities live.

👋 Final Thoughts

If you’re ready to dive in:

Use my referral links to start your journey today:

https://coinbase.com/join/3RWAQDX?src=ios-link

https://wallet.uphold.com/signup?referral=f6ea7bb6ba&campaign=uw_p_d_w_acq_raf&utm_source=raf&utm_medium=referafriend

Follow me on X (Twitter) 👉 @XRPNurse for daily insights, tips, and my own crypto journey.

Remember: every expert once started as a beginner. Maybe your first $20 in XRP will be the beginning of something life-changing. 🌍✨

The Future of Money in Plain English

Blockchain, Crypto & Digital Assets: A Simple Guide to the Future of Money

If you’ve ever wondered what the big deal is about blockchain and crypto, you’re not alone. When I first started learning about this space, I wasn’t trying to decode computer science textbooks I just wanted to understand one thing: What makes money valuable?

Turns out, that question opened the door to one of the biggest technological shifts in our lifetime.

The Story of Money: From Seashells to Digital Dollars

Thousands of years ago, people didn’t use dollars or credit cards. They traded with things they believed had value like seashells, salt, or cattle. Eventually, societies created coins made of gold and silver because those metals were scarce and trusted.

Fast forward: governments began issuing paper money. At first, every dollar represented a chunk of gold stored in a vault. But over time, governments removed that “gold backing.” Today, money is mostly numbers on a screen—a promise backed not by gold, but by trust in the system.

So the big question became: Can money exist without a central authority like a bank or government?

Enter Blockchain: The Trust Machine

This is where blockchain comes in.

Think of blockchain like a giant public notebook. Every transaction is written down, verified by many people at once, and impossible to erase. No single government, bank, or company owns it.

That’s why it was revolutionary it created trust without needing a middleman.

For example:

If you send me $20 on Venmo, we rely on a bank to keep score.

If you send me $20 worth of XRP or Bitcoin, the blockchains themselves keeps score instantly, globally, and without asking permission from a middleman.

Crypto & Digital Assets: Beyond Just Money

Bitcoin was the first use case: digital money you could send anywhere, anytime. But blockchain isn’t just about payments. It’s expanding into industries we use every day:

Healthcare: Imagine your medical history stored securely on blockchain—accessible by doctors anywhere, but only with your permission.

Real Estate: Buying property without stacks of paperwork, because deeds and titles can live on blockchain, verified instantly.

Music & Art: Artists can sell songs or digital art directly to fans as NFTs (non-fungible tokens), without losing a cut to big corporations.

Finance: Decentralized finance (DeFi) lets people earn interest, borrow, or trade without banks—anywhere in the world.

This is why people call blockchain the “internet of value.” It’s not just sending information (like emails or videos). It’s sending money, ownership, and trust over the internet.

My Journey: From Curiosity to Conviction

My first step into this space wasn’t buying Bitcoin or opening a crypto wallet—it was asking why money has value at all.

The more I learned, the more I realized: governments print money at will, inflation eats away at savings, and traditional systems aren’t always fair. Blockchain flipped that upside down by being transparent, open, and borderless.

At first, governments fought it—calling it risky, unregulated, even illegal. But slowly, even they began to see its power. Today, we’re watching countries, banks, and corporations explore how blockchain can reshape the financial system.

How You Can Get Involved

You don’t need to be a tech expert to start. Here are a few easy ways:

Learn First: Read blogs (like this one), watch videos, and follow thought leaders. Knowledge is the first investment.

Dip Your Toes In: Open an account on a trusted crypto exchange and buy a small amount—just enough to feel the process.

Experiment: Try sending a few dollars of crypto to a friend. It’s faster and easier than you think.

Think Long-Term: Just like the early internet, we’re still in the early chapters of blockchain.

Final Thought

The history of money is the history of trust. Seashells, gold, paper, digital numbers each step was about how people agreed to exchange value.

Blockchain is simply the next chapter. A chapter where money, assets, and information are open, transparent, and borderless.

For me, learning this changed how I see not just money but the future. And we’re all still early.

The Business of Caring: When Assisted Living Becomes a Balancing Act

Caught Between Compassion and Cost: A Nurse-Turned-Administrator on the Business of Assisted Living

Someone who started as a nurse—drawn into this field by a calling to help—and now serving as an Executive Director, I’ve lived in that tension: trying to balance heartfelt care with razor-thin margins.

What’s become clear is that more and more compassionate leaders are leaving this industry. Not because they don’t care, but because the constant exhaustion of pushing back, advocating, and holding the line against operator demands takes its toll. The business side has a way of grinding down the very people who entered this field to protect residents and staff.

In my opinion, the assisted living industry is transforming—but not always in ways that serve residents first. With fewer leaders willing or able to fight for what’s right, the system bends further toward profit and away from people. And often, the more I see from the inside, the more questions I have and fewer concrete answers.

The Silver Tsunami Is Real—and UnforgivinG

We’re heading straight into a demographic tidal wave. Every single day, 10,000 Baby Boomers reach retirement age—a surge that won’t slow until at least 2030. By then, the U.S. could need 3,000 new nursing homes just to keep up. And even that’s not enough. To maintain today’s market penetration, we’d need nearly 600,000 more senior housing units by 2030.

The assisted living market was valued at $44 billion in 2024 and is projected to double by 2033. The demand is undeniable. The frustrating part? The need is crystal clear—yet the solutions remain blurry, slow, and nowhere near the pace required.

Care Costs Climbing—But Profits Still Pulse

Between 2004 and 2021, the cost of assisted living climbed 31% faster than inflation, landing around $54,000 a year. At the same time, 4 out of 5 facilities are for-profit, and nearly half report returns above 20% margins you rarely see in healthcare. Families are stretched thin, sometimes paying $11,000 a month, only to be hit with hidden fees and disappointment instead of the dignity they were promised.

As an administrator, that’s maddening. I came into this work to care for people, but too often the business model pushes profitability first—and residents second.

Staff Scarcity: The Heart of the Crisis

Behind nearly every care lapse is the same root cause: not enough staff. About 87% of nursing homes report moderate to severe staffing shortages, and turnover in this field hovers around 53% every year. Assisted living, in many cases, survives on the backs of underpaid caregivers—often immigrants—working multiple jobs just to make ends meet.

The heartbreaking truth? Even families with resources aren’t guaranteed good care. I’ve seen cases where neglect and hidden fees devastated families who were paying top dollar. And across the country, many frontline caregivers in long-term care earn around $15 an hour, enduring heavy workloads and limited benefits to care for our most vulnerable.

So Where Does That Leave Us?

This is where I get stuck: I feel for caregivers and residents. As a nurse, I know what quality looks and feels like. As an administrator, I face budgets, loans, occupancy targets, and the unrelenting need to break even—even as demand surges around me.

We need systemic reform:

Policy incentives—like tax breaks or subsidies to encourage nonprofits or ethical operators to stay afloat.

Government or philanthropic support—imagine Medicaid/Medicare redesigns that reward compassionate care, not just occupancy.

Nonprofit or hybrid models, perhaps blended with mission-driven capital.

Innovative alternatives—like home health tech, robotics, and “hospital-at-home” models that may lighten residential demand and enhance dignity .

But let’s be honest: these ideas are still mostly from research or headlines. In practice? We’re scrambling to staff shifts, shore up revenue, and keep residents safe—with no guarantee the system will adapt fast enough.

Final Thoughts: The Care Shouldn’t Cost Lives

The unmet need is massive and growing. The industry has tilted—sometimes cruelly—between human care and financial survival. As a caregiver at heart now managing budgets and compliance, it’s infuriating to see cost cutting become the default fuel for survival.

I don’t yet know the perfect solution—whether it’s market incentives, regulation, or new care paradigms like staffing technology or mission-led nonprofits. But one thing I’m sure of: caring should never be sacrificed for survival. And lives should never be the cost of doing business.

Disclaimer: The views shared here are solely my own and do not reflect those of my current employer. They are based on my personal opinions and experiences gained over 15 years in the industry.

The Trade That Cost Me $200,000 + USD

The Humble Studio in Santa Barbara

It was supposed to be a quiet night in my tiny studio apartment in Santa Barbara. I had just started dating a new girlfriend, and life felt simple, full of possibility. But what happened that night changed the way I looked at money, risk, and myself forever.

Discovering the Beast Called Leverage

I was still new to trading, curious and hungry. I had been experimenting on different exchanges, testing out features like a kid in a candy store. That’s when I stumbled across Bybit. One feature immediately caught my attention: leverage trading.

The idea was intoxicating—borrow more than I had to multiply the profits. Why settle for small gains when I could turn a modest trade into life-changing money? With stars in my eyes, I opened a 10x leverage position.

What I Didn’t Know About Leverage (But Learned the Hard Way)

For anyone new, here’s what leverage trading really means:

You borrow funds from the exchange to increase your buying power.

A 10x position means if you put in $1,000, you’re trading as if you had $10,000.

Sounds powerful—but it’s a double-edged sword. The same multiplier that boosts your gains also multiplies your losses.

If the market moves even slightly against you, the exchange will liquidate your position—wiping you out instantly.

And that’s exactly what happened.

The 15-Minute Meltdown

I didn’t set stop-loss orders. I didn’t have a risk management plan. I thought I had time to react. But crypto doesn’t wait.

Within 15 minutes, the market whipped in the wrong direction. I watched in horror as 68,000 XRP—my entire position—vanished from my account. Years of savings gone in a blink, swallowed by the volatility of the market I thought I could tame.

The Silence That Followed

The shock froze me. I slid onto the floor, staring at the screen as if sheer willpower could bring my balance back. My girlfriend sat nearby, wide-eyed, watching me collapse into disbelief.

Through a whisper, I told her the words I could barely believe myself:

“I just lost 68,000 XRP.”

The silence in that room was heavier than any sound I’ve ever heard.

The Lesson Etched in Pain

Devastated doesn’t even begin to describe it. What I lost that night—what would be worth close to $200,000 today—could have changed my entire future. But instead, it became the most expensive education of my life.

That loss lit a fire in me. My nature wouldn’t let me quit. Instead, I sharpened my vision. I studied. I dissected every mistake. I learned the ins and outs of trading strategy, risk management, and patience.

The Spark of What Was to Come

In that tiny studio in Santa Barbara, I learned a brutal truth: in the world of crypto, you either get devoured or you evolve. That devastating moment pushed me into evolution. It was the spark that opened opportunities, gave me discipline, and carved the path to the investor—and person—I’ve become today.

I’ll never forget the night 68,000 XRP disappeared. But I also know it was the moment I was reborn as a trader.

The Beginning: My First XRP Purchase

The Decision to Dive In

Every investor remembers their first buy. For me, it was supposed to be simple: log in, click “purchase,” and boom—I’d own my first XRP. Easy, right?

Wrong.

Back in early 2017, deciding to buy XRP meant entering a maze. It wasn’t just a financial decision—it was a leap into uncharted territory. I had no idea that the moment I hit “go,” I was about to stumble into a world that felt like the Wild West of the digital frontier.

The Hunt for XRP

I quickly realized that buying XRP wasn’t like buying Apple stock or swiping a card for groceries. No U.S. exchange made it easy. Most didn’t list XRP at all, and the ones that did seemed shady, confusing, or unreliable.

The frustration set in. Here I was, ready to invest, but everywhere I turned I hit a wall of government red tape and lack of access. U.S. citizens had zero direct on-ramps—no bank account links, no debit cards, no credit cards. Just a bunch of dead ends.

Enter Binance (and the VPN)

After scouring forums, Reddit threads, and late-night Google searches, I discovered Binance—a relatively new exchange at the time. Hope sparked… until I realized another obstacle: Binance wouldn’t just take my cash. To buy XRP there, I first had to own Bitcoin, Ethereum, or Litecoin.

Even creating an account wasn’t straightforward. As a U.S. citizen, I had to use a VPN just to sneak past restrictions. It felt like playing cat-and-mouse with the system, doing whatever I could just to get in the door.

My First Detour: Bitcoin

With no other choice, I went hunting for Bitcoin. I ended up on an app called Abra, where I wired $500 straight from my bank account. A nerve-wracking wait later, I finally had about 0.45 BTC in my hands.

At the time, Bitcoin was trading around $1,100—a number that almost feels unreal today. Still, I wasn’t here for Bitcoin. I was on a mission for XRP. And to get it, I had to move that BTC across the blockchain, through exchanges, and finally into the waiting arms of Binance.

The Longest Wait of My Life

If you’ve ever transferred crypto, you know the feeling. You hit “send,” and then… nothing. Just waiting.

Watching my Bitcoin leave Abra and waiting for it to land in Binance was excruciating. Every second felt like an hour. What if it got lost? What if I copied the wrong wallet address? Would my $500 just vanish into the digital abyss?

Refresh. Refresh. Refresh.

And then—it arrived.

The Big Moment: Trading for XRP

My heart raced as I pulled up Binance’s trading screen. It was clunky, confusing, and intimidating. But I was determined. With shaky hands, I entered my trade: all of my Bitcoin into XRP, then hovering around $0.11.

After spreads, fees, and a crash course in trial-by-fire, it was done. Sitting in my account, gleaming on the screen, was my very first bag of XRP: 4,100 coins.

Frustration Turned Into Fire

That moment was electric. All the VPN headaches, endless searching, and transfer delays suddenly felt worth it. I hadn’t just bought crypto—I had fought for it.

I walked away that day not just as a new investor, but as someone who had wrestled with the chaos of a brand-new financial system and claimed a stake in its future.

And that first bag of XRP? It wasn’t just digital currency. It was the spark that lit the fire for everything that came after.

My Crypto Journey: From Skeptic to Believer

My journey into the world of cryptocurrency started back in early 2017. A friend introduced me to a new word—“crypto”—and began explaining concepts like cryptocurrencies and blockchain technology. At first, I thought he was a little crazy. He spoke about how this technology could revolutionize finance, but with so much government red tape and regulation, I was highly skeptical about putting any of my money into it.

At that time, I was just getting started in the investment world myself. I had only recently begun allocating funds into traditional stocks, so the idea of buying into this mysterious digital currency felt like a huge leap.

But while I hesitated to invest, I had something else on my side: time. And I used that time to start researching.

Discovering the Flaws in the System

The deeper I looked, the more I realized how antiquated our banking system really is. From unnecessary friction in transactions to the lack of transparency, it became clear to me that blockchain offered a potential solution to many of these problems. The more I learned, the more my skepticism began to turn into curiosity.

I went down countless rabbit holes—studying how the technology worked, exploring different use cases, and slowly beginning to understand why this wasn’t just another trend. It was an inevitable evolution.

The Learning Curve

Eventually, I decided to take the plunge and buy my first cryptocurrency. From there, it truly felt like a game—one where the goal was to win big by investing early in a future I now believed was unavoidable: mass adoption.

Along the way, I learned about the practical side of crypto:

The difference between cold wallets and hot wallets.

How to use a crypto exchange, and the difference between centralized and decentralized platforms.

The importance of security and holding assets responsibly.

Every lesson was part of the journey, and every small win reinforced my conviction that I was witnessing something monumental.

From Skeptic to Advocate

What began with doubt slowly grew into passion. Crypto wasn’t just about making money—it was about being part of a movement that could reshape finance, technology, and opportunity for everyone.

That’s how my journey started, and why I continue today not just as an investor, but as someone who enjoys sharing knowledge, helping others, and exploring the endless possibilities this space has to offer.